Technology Detects Noncompliant Vehicles in Real Time

Studies suggest that about one quarter of drivers on the roads of Oklahoma drive their vehicles without insurance, despite a legal obligation that motorists must have coverage.

Funded by the notice fees paid by registered vehicle owners and operated by the Oklahoma District Attorneys Council, the UVED Program is designed to address this crisis by alerting motorists that their vehicles are uninsured, a violation of law in Oklahoma and most states.

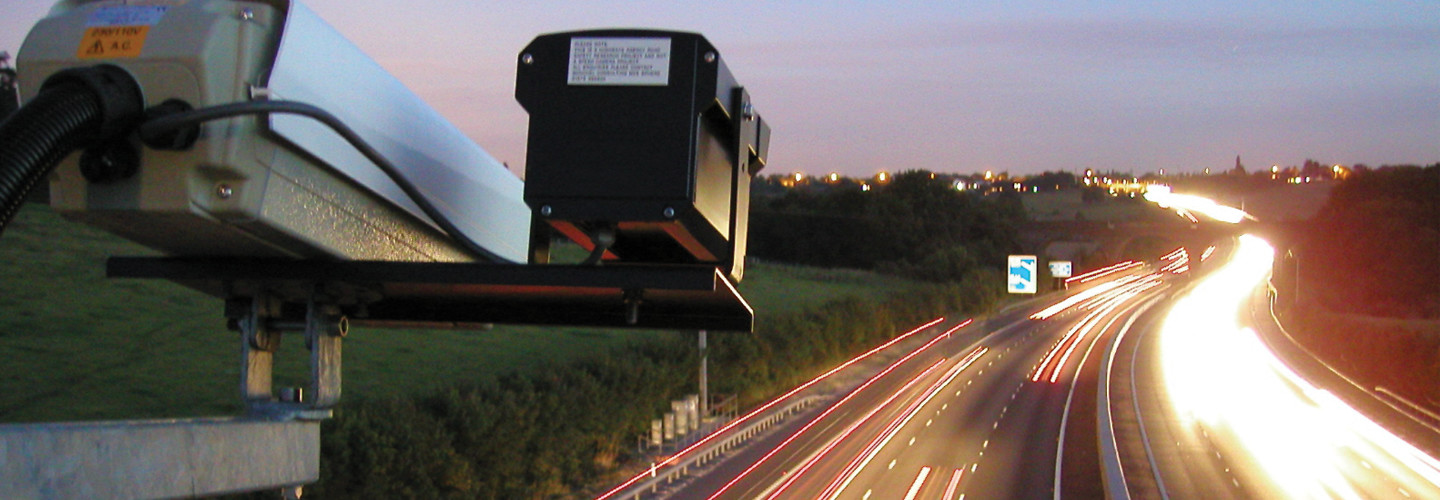

As motorists travel on the state’s roads and highways, strategically placed sensors capture images that include each vehicle’s make, model, color and license plate. Video analytics then automatically compare the images to the state’s real-time insurance verification system.

When an uninsured vehicle is detected, an evidence package is sent to the DAC. Upon review, the motorist receives an automatic notice to respond in the mail, encouraging them to obtain insurance and enter a diversion program in lieu of prosecution.

DIVE DEEPER: What is behind the push for smarter roads?

Getting Drivers Back on the Road, Legally

A key goal of the UVED Program is to divert cases of insurance noncompliance away from the court system.

Although owners of vehicles found to be operating without the requisite coverage could be charged with a crime, the UVED Program seeks to keep Oklahomans away from criminal proceedings by notifying the owners of uninsured vehicles about the potential for charges — before law enforcement intervenes.

Recognizing that one of the reasons for the state’s high number of uninsured drivers is that many can’t afford insurance, the UVED Program developed a web portal where citizens can explore low-cost coverage options and avoid potential penalties.

To encourage drivers to opt in to the program and get back on the road legally, the DAC’s office also coordinated a public outreach effort through print, television and social media.

EXPLORE: Michigan wants to experiment with autonomous vehicle technology.

How Oklahoma Addresses Data Privacy Concerns

Protecting data privacy is of paramount concern when identifying vehicles for noncompliance. Many vehicle recognition technology vendors store license plate data and sell it back to law enforcement clients or third parties.

The Oklahoma UVED Program does not do this. All data collected by the state cameras is retained solely by the program and only for as long as it’s being used as evidence of a violation; when the data is no longer needed, it is destroyed. The UVED Program headquarters is also a physically secure facility.

Today, the program has nearly 50 cameras in each of its 27 district attorney districts — all launched in just 61 days. The payoff has been significant: Since 2018, the number of uninsured drivers on Oklahoma’s roads has fallen from 350,000 to approximately 215,000, making the state’s roadways safer for everyone.